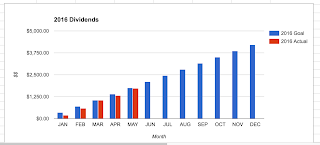

Wanted to do a post to wrap up my first full year with DGI.

Buying Stocks

1. Averaging down or paying shitting prices is only awesome if you plan to buy that stock monthly or quarterly, so its ok to wait for a good entry. To facilitate this I've 1) noted in my "want to buy" list what the price was when I was interested in the stock. In some cases the stock is way down (example CMI), others its way up (CLX), 2) I've added a very simple calculation to my monitoring sheet to show if the stock is a fair value or not. I'm doing this by multiplying EPS x PE to determine a very rudimentary Fair Value price. If the stock is below this price it highlights the "Buy" box in green.

I'm not sure if this will make any difference over the year but I'm going to use it to help allocate additional funds throughout the year if I'm unsure what to add to or have no strong opinion between a few stocks I'll add to the one that is below the fair value. I also use Daily and Weekly squeezes.

Reference: https://www.youtube.com/watch?v=lbmUfauTGkU

2.

I'm not going to front load my IRA in January. Last year I bought a bunch of stuff in January and have stared at it being red most of the year. So using #1 I'm going to space out IRA purchases this year and see how it goes. A few things I'm interested in have some squeezes to the downside setting up. I've set up some alerts on most and a GTC limit order on some others. Lots of buy orders kicked off. I ended up front loading the IRA. Guess I'll see later how that turned out.

Taxes

Mo' Money Mo Problems was the phrase for 2015.

|

| Mo' Money Mo' Problems dawg |

I made the most I've ever made this year and didn't have nearly enough taken out for taxes. End result; big fat tax bill (estimated). Which leads me to deductions.

1. I'm a big believer in the Rich Dad Poor Dad philosophy of learning how businesses save on their taxes and putting that to work in your own life. So I have a LLC and usually get at least one 1099 job a year in order to take the business deductions, home office deductions, and the other tax breaks that come from running your own business. I highly recommend everyone look into this.

2. Using its deductible is great for itemizing and getting the most out of de-clutering but you have to put the effort into categorizing everything and entering the results into the web site. When I got lazy and tried to remember later or by looking at pictures I didn't get near the deduction value over when I enter the amounts of goods into the site BEFORE I take stuff to goodwill/salvation army. When you owe, every dollar of deductions count.

3. I have a ton of computer books that I have read/don't need. Its been a real chore to get rid of these things. I've sold some at my local used book store in town which gives either cash or store credit (more value than the cash). The kids like books so I usually take the store credit and let them pick out books there instead of B&N. Save that $$$. For newer books the Amazon trade-in program is pretty good. You send in the books and get Amazon credit. Lastly, and why it's in the taxes part of this post is you can donate them for pretty nice values.

|

| Book donation values in itsdeductible |

Moral of the story, if you can't get cold hard cash...cold hard deductions are pretty ok.

Being Frugal

Gonna keep working on it. Its a fine line between delaying life later for when you are too old to enjoy it and banking that cash. Big goal for 2016 is cutting the cord which should save me over 100 bucks a month.